There is a lot of nonsense written about copywriting.

The more prescriptive copy writing courses describe how to write copy, seemingly suitable for any PPC campaign, regardless of audience. “Use big hooks, create immediacy, use long sales copy, tell a story, start with “Dear Friend”.

There’s really no such thing as generic rules for copywriting.

In order to write copy that sells, a writer must make the right offer to the right audience. No matter how well copy is written, if the offer isn’t compelling to the target audience, then PPC campaigns won’t succeed.

Therefore, good PPC copywriting should start before a word hits the page. Good PPC copywriting starts with market analysis, observation and understanding people.

1. Compare Your Offer

The first step is to undertake market research. Compare your offer with those of your competitors.

Examine the existing PPC ads in your niche. Pay the most attention to the top three advertisers. If they keep advertising for any length of time, their offer is resulting in high enough click-thru rates, and return, to earn them those positions.

They most likely have the offer and wording right, or close enough.

Compare the top three ads with those ads lower down. Bid prices and other metrics aside, the top advertisers often use wording that is more compelling. Do you notice a marked difference in wording and the way the offer is presented? Are they giving something away for free? Are they promising something that sounds remarkably valuable?

Next, examine the advertisers landing pages using the same criteria. Take note of what they are asking the audience to do. Are they asking people to “Buy Now”? Are they merely asking them to give an email address? Are they giving away something for nothing? Are they putting fewer hurdles in the way of the visitor that their competitors?

Make sure your offer is at least as good as theirs. In fact, you should aim to beat their offer. When the competition is only a click away, it makes it very easy for people to compare offers.

Make sure your offer is the most compelling.

2. Understand Your Market

Who is your market?

Try to imagine the people who buy from you, as if they were walking into your shop or office. How old are they? What jobs do they have? How much money do they have? What do they need so badly that they will buy it from an anonymous supplier they have never heard of before until now? What will stop them buying from you, even if they need what you have? Why aren’t they going to a local brick-n-mortar supplier, or a major retailer, to buy your service or product?

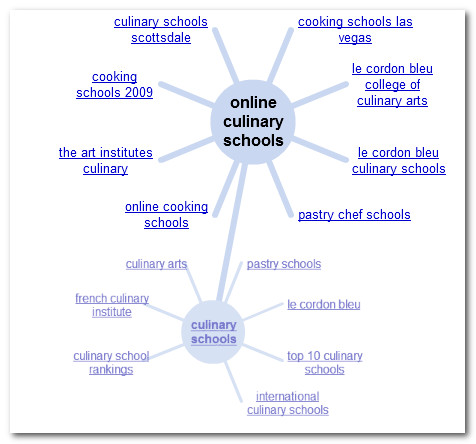

You also need to know how they talk about their need.

Someone who has a sore ear might talk in terms of symptoms, or they may leap straight to diagnosis. They may worry they have something serious and simply be looking for reassurance from an authoritative source. Or they may describe their symptoms. They may have had the condition before and be in search of a new remedy. They may want to find out where to find a local doctor.

Same problem, much the same market, but different requirements.

By examining how people talk about their need, you’re more likely to be able to pitch an offer they want. If you’re selling remedies online, then most of these visitors aren’t people you should be targetting, at least not directly. This is what is known as market segmentation, or dividing the market into subgroups with similar motivations. Your offer should be pitched at the right subgroup, which will not only result in higher conversions, it will reduce your PPC spend.

By now, you may be thinking that this all sounds too hard. Isn’t this type of market research expensive and time consuming?

It can be, but there are a number of cheap and cheerful ways you can get such information.

Buy market research reports. It is reasonably cheap to obtain generic research reports. Whilst not as good as data gathering specifically for your purpose, they can provide valuable insights into market trends. For example, many people who seek medication on the internet worry about safety. Your copy may seek to ally such fears.

A/B testing. People engaged in PPC often use A/B testing, also known as split run testing. For those new to PPC, A/B testing is when you test one landing page against another. Each page will be different, featuring alternative wording and or layout. The page that results in the most sales, wins. Here’s a good overview of A/B testing.

Ask your customers. The best people to ask are the people who have bought from you. You can use simple surveys, and offer people rewards in exchange for their views. Why did they buy from you and not the others?

Ask your non-customers. The conversion percentage of most websites is low, around 3%-10%. That means over 90% of people aren’t interested in your offer. Why not? Is there a way you can capture this information before they leave? It might be as simple as prompting them with a dialogue box or chat box. You could ask them to sign up for a newsletter by giving them something of value, so you can extract this information at a latter date.

Facebook/Twitter/Social Networks – these can be great places to learn about your target demographic. Join groups relating to your niche and observe. Note the way they talk, the words they use to describe needs, the sites they recommend and their interests.

Aligning Your Copy With Your Market

By now, you have two very important pieces of information on which to base your copy. You understand something about your audience, and you understand the nature of the other offers they may be seeing.

Make a more compelling offer than your competitors. Make an offer that is closely aligned with the needs of your market, and phrased in their terminology. Cover the basics – create a message that has emotional appeal, is personal and conversational. Repeat the call to action clearly and often.

Above all else, keep it simple.

Even if your target audience is high-brow intellectual, it doesn’t necessarily mean they want to be pitched in such terms. The may require extensive detail, they may require obscure specifics, but it’s usually best to relegate such detail lower down the page, or off to a separate page. The thing they need to be crystal clear about is your offer and how it benefits them.

Whoever our audience, they most likely fall into one of four distinct groups:

The Unaware

They know they have a need, but they haven’t thought much beyond that point. This type of person requires a lot of education about the problem itself, then the solutions.

The Ambivalent

They have a problem, and they know something about the solutions, but they’re not sure they really need to solve the problem. At least not right now. Maybe tomorrow. You need to spend a lot of time focusing on the solution, the merits of the solution, and why acting sooner than later is in the buyers best interests.

The Hunter

They know they have a problem, and they know about the solutions, but they’re hunting around for the right deal. You have to convince them that your offer is the best one for them. Convince them that they are smart for deciding to go with you.

The Desperate

They must have what you’re selling. This is the dream buyer. They want to buy quickly, so get out of their way and enable them to do so. Use credibility markers and a clear, precise sales process.

I’m skating over the surface, as I’m sure these aspects aren’t new to you, but it’s a good idea to keep in mind what stage a buyer may be in the buy cycle. As you can see, it will change the emphasis of your pitch.

There’s one other important aspect to landing pages that is seldom, if ever, mentioned in traditional copywriting manuals.

Interactivity.

The easiest thing for a consumer to do is click links and buttons. So offer them something to click. It’s an affirming action, so long as that click isn’t back!

This also serves to draw people deeper into your world. You can segment your visitors by offering them different click paths, and so craft the message specifically for that type of buyer over a series of pages. Different types of visitors will take different click paths.

You can also match up click paths with keyword terms, thus helping you improve your targeting in future. For example, you may find that people who searched on “ear infection” tended to opt for click paths that offered deeper, diagnostic information. In future, you may bring people who search on “ear infection” directly to a page oriented around diagnostic information.

Attention spans are getting shorter. Long sales copy pages, particularly when used as landing pages, are becoming less common than they were a few years ago.

A YouTube/FaceBook, brought up on on-demand media and instant gratification generation isn’t going to spend a lot of time reading long text blocks. An older audience may do so, yet another reason for understanding and segmenting your audience.

This is not to say long copy sales pitches do not work, but if you use them, be sure to “chunk it” i.e. regularly restate your offer, and offer the call to action, after making each point, or after every few paragraphs. This means visitors don’t need to read the whole thing in order to understand your offer.

We’re also seeing a lot of landing pages that offer video and audio, and very little in the way of text. The copywriter is not out of a job, however, as the script is just as important as the written word. We have the ability to make landing pages very rich and compelling, but the use of technology should never distract from the fundamental principles: make the right offer to the right audience.

A Final Note On Credibility

We live in a world where trust isn’t what it used to be.

In times past, people tended to place more trust in authority that they do now, including the claims made by advertisers who appeared in trustworthy magazines and newspapers. This is still the case, in some demographics – typically elderly – but generally speaking, we live in very cynical times.

And it’s no wonder. By the time a person reaches an age where they become an active consumer, they’ve been bombarded with millions of messages. Messages saturate every media, so in order to retain any sanity, people get very good at tuning most of them out.

Unless it relates directly to them.

Again, this is why focusing on people, their needs, and how they say things is crucial. In the 10’s, we need to speak the customers language more than ever. They have the back-click button. Those under 30 have most likely been brought up in a world where they are the center of the universe. It’s all about them. So credibility, in this day and age, is largely about holding up a mirror to the audience. If you appear to be like them, then they tend to trust you. There are many markers of trust, of course, but bear this point in mind, particularly for youth demographics. If your copy talks down to them, or assumes to be the voice of authority, you’ll likely lose them.